What Is A Loan Term?

Loan term shows how long you have to repay a loan. This affects your monthly payment amount and total interest paid. The term “loan terms” covers the length you have to pay back, the interest rate, and the fees. It’s key for people getting a loan to understand these terms. They help you see what you’re agreeing to and how to manage your payment.

Remember, loan terms change depending on the loan type. Whether it’s a mortgage, auto loan, or personal loan, they will be different. So, it’s vital to carefully check and understand all the loan’s terms.

Key Takeaways

- A loan term refers to the length of time you have to repay a loan, which impacts your monthly payment and total interest paid.

- Understanding loan terms is crucial for borrowers to make informed decisions when taking out a loan.

- Loan terms can vary significantly depending on the type of loan, such as a mortgage, auto loan, or personal loan.

- Reviewing loan terms carefully is important to ensure you fully understand the terms and conditions associated with the loan.

- Loan terms include the repayment period, interest rate, fees, and other conditions of the loan.

Understanding Loan Terms

Loan terms are the set of rules both the lender and borrower agree on when a loan is taken. They cover the length of the loan, how much to pay every month, the interest rate, fees, and any extra rules or needs. These terms are written down in a contract. It’s very important for borrowers to know these terms well. They show what the borrower needs to do and the total cost of the loan.

Defining Loan Terms

Loan terms are like a user manual for the loan. They specify the length of time for paying back, the schedule to pay, interests, and any extra charges or penalties. It’s key for people borrowing money to understand these terms. This helps them choose wisely and handle their debts well.

The Importance of Reviewing Loan Terms

It’s crucial for borrowers to carefully check the loan terms. They need to know payment dates, possible fees, and how it all affects the monthly and total costs. Looking over these details helps people make better choices and maybe even get better terms. This can make the loan more suitable and cheaper for them.

Key Components of Loan Terms

The loan repayment period is how long a borrower has to pay back the money. It can be a short 12 months or as long as 30 years or more. This time frame affects both the monthly loan payments and the final cost with interest. Shorter loans have higher monthly payments but less interest cost. Longer loans mean lower monthly payments but more interest over time.

Interest Rate and Fees

The interest rate and fees are also important in loan terms. The interest rate sets the APR and the total interest paid over the life of the loan. Fees, like origination fees and prepayment penalties, also stack up. It’s key for borrowers to understand these costs to know the full cost of the loan.

Additional Conditions and Clauses

Loan terms can have more detailed conditions and clauses too. These might include default clauses or rules about refinancing. Borrowers need to check these to avoid surprises later. Understanding is important. It helps avoid problems like not being able to pay early without extra charges.

Loan Term

The loan term is how long you have to pay back a loan. It changes based on what kind of loan you have. This could be a mortgage, auto loan, or personal loan. It’s vital for borrowers to think about the loan term to make sure they can easily pay back the loan in time.

| Loan Type | Typical Loan Term Range |

|---|---|

| Mortgage | 10-30 years |

| Auto Loan | 24-84 months |

| Personal Loan | 12-60 months |

The loan term affects how much you pay each month. It also influences the total interest costs while you’re paying off the loan. People should look at their money situation and why they need the loan before picking how long they have to pay. This helps them meet their money goals better.

Loan Term Length and Implications

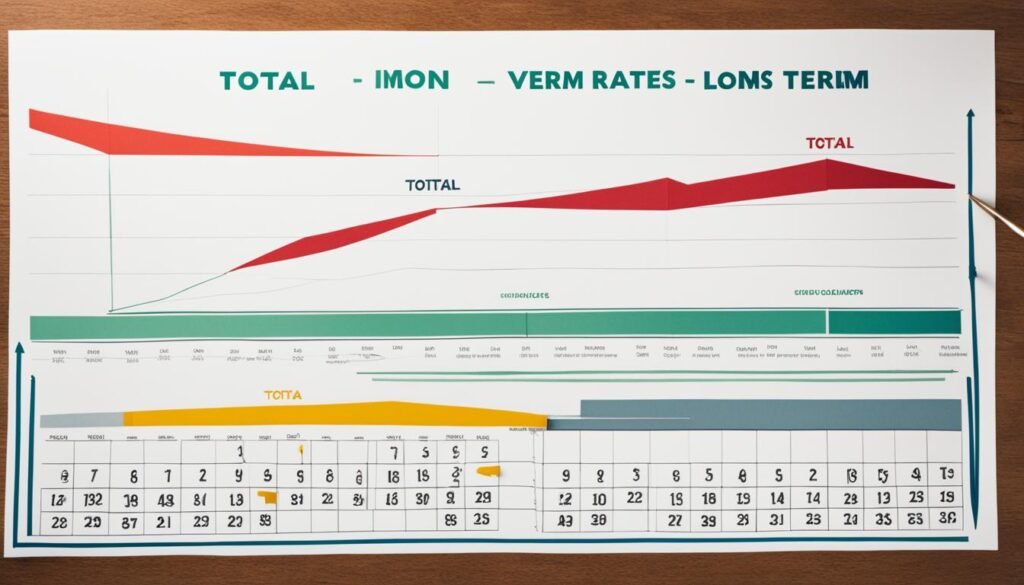

The length of your loan term affects how much you pay each month. Short loans, like 15-year options, make each payment higher. But, you pay less in total interest costs. Longer terms, over 30 years, have lower monthly costs but more interest expenses.

Impact on Monthly Payments

The loan term length impacts what you pay each month and in total interest costs. Choosing a shorter term means you pay less in interest expenses. This is because you pay more of the principal balance every month. But, with longer terms, you might pay more in interest costs overall. This is even if each monthly payment is smaller.

Impact on Total Interest Costs

It’s essential for borrowers to think hard about how loan term length affects payments. This can help them choose a loan that fits their goals. Understanding these details could mean a lower monthly payment or paying off the loan sooner. It all depends on what you can afford and your financial plans.

Factors Influencing Loan Term Choice

When looking at loan term options, consider your finances. Think about your current income and debts. Also, think about your budget. Your ability to pay more each month or wanting to pay less over time affects your choice.

Personal Financial Situation

Your financial situation plays a big role in choosing the right loan term. Things like your income, current debts, and budget matter. They affect if you can choose a shorter loan term to save on interest.

Purpose of the Loan

The reason for the loan also matters. For big buys like a house or car, you might want a longer loan term. This spreads the payments out. But for personal loans or to pay off debt faster, a shorter term could be better.

Shorter vs. Longer Loan Terms

Advantages of Shorter Terms

Shorter loan terms, like 15-year mortgages or 60-month auto loans, have their perks. You’ll pay less total interest over the loan’s life. Plus, you’ll be debt-free faster. You’ll also own more of the house or car sooner. Yes, the monthly payments are higher. But, it means saving more money over time.

Advantages of Longer Terms

With longer terms, like 30-year mortgages or 84-month auto loans, your monthly payments are lower. This is great if money is tight or you want more cash each month. It’s especially helpful for costly buys like homes or cars. The lower monthly costs help keep the loan affordable. Yet, you will pay more in total interest by the loan’s end.

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 15-year Mortgage | $1,200 | $75,000 |

| 30-year Mortgage | $800 | $150,000 |

| 60-month Auto Loan | $500 | $5,000 |

| 84-month Auto Loan | $350 | $8,000 |

Negotiating Loan Terms

When you’re dealing with loan terms, there’s room to negotiate. This is true for personal loans, mortgages, or any loan. Negotiating can help you get better conditions. It lets you pay less and fit the loan into your budget for the long run.

The loan term length is a key point for negotiation. You can ask for a shorter term to save on interest costs. Or, ask for a longer term to make monthly payments lower. The interest rate is also crucial. If you have good credit, you might get a lower interest rate and save money over the loan’s life.

Don’t forget about loan fees like origination fees and prepayment penalties. Try to get these fees reduced or waived. This can lower your overall loan cost. Getting good loan terms means knowing the lender’s rules and your own finances. It’s about smart strategy and being ready to talk. So, negotiate wisely to meet your financial goals and pay off your loan over time.

Reading and Understanding Loan Agreements

Borrowers need to know what an amortization schedule shows in a loan agreement. It tells you how much of your loan payments go to principal and interest. This schedule helps you see the total interest costs and when the loan balance will drop.

Amortization Schedules

The amortization schedule is key in any loan deal. It shows the loan term, if it’s fixed-rate or adjustable-rate, and how each payment splits between principal and interest. It helps you know when to pay, the amortization period, and loan maturity. These are important in figuring out the total cost of the loan.

Prepayment Penalties

Some loans might have rules about prepayment penalties. These fees happen if you pay off your loan early. Be sure to check these rules, especially if you might make extra payments or refinance.

Default Clauses

Loans also outline what happens if you don’t make payments on time. This can mean late fees, harm to your credit, or losing the thing that secures the loan. Knowing these rules is important. It can help you avoid legal or money troubles.

Types of Loans and Their Terms

Knowing loan terms is key for making good borrowing choices. Each loan type has unique terms. Let’s look at the main ones for different loans.

Mortgages

Mortgage loans usually last 10 to 30 years. The 15-year and 30-year terms are most common. The time of the mortgage affects how much you pay every month and the total interest you pay. There are also fixed-rate and adjustable-rate mortgages, each with its own details.

Auto Loans

Auto loans are often shorter, from 24 to 84 months. The time you get depends on the car’s age, your credit, and what the lender offers. Always check for any extra costs like paying off early.

Personal Loans

Personal loans can last from 12 to 60 months. The time depends on how much you’re borrowing and your credit. Terms for personal loans are more adjustable. This lets you pick a time that works for your budget. Make sure you understand all the charges or fees.

Also Read : How Do I Choose The Best Loan Option For My Financial Situation?

Conclusion

It’s vital for borrowers to understand loan terms and conditions. These include how long you have to pay, the interest rate, and any fees. Knowing these can help you figure out your monthly payments and the total cost of the loan.

When you know the payment deadlines and loan costs, you can pick better loan options. This way, you can save money, pay back the loan easily, and reach your financial goals. It’s about making smart choices with your money.

Understanding loan terms well is key when borrowing. It helps you meet your financial goals and reduces your loan’s long-term costs. By knowing and grasping the loan terms, you can confidently find the best deal for you.

FAQs

Q: What are loan terms and conditions?

A: Loan terms and conditions refer to the specific details and requirements outlined by a lender for borrowing money. These terms include the interest rate, repayment schedule, fees, and other important information related to the loan.

Q: How do I choose the right loan offer?

A: To choose the right loan offer, you should consider factors such as the loan amount, interest rate, repayment term, and any fees associated with the loan. Compare multiple offers from different lenders to find the best option for your financial needs.

Q: What does extending your loan term mean?

A: Extending your loan term means lengthening the period over which you will repay the loan. While this may result in lower monthly payments, it can also increase the total amount of interest you pay over the life of the loan.

Q: What is a longer-term loan?

A: A longer-term loan is a type of borrowing that has an extended repayment period, typically more than five years. Longer-term loans may have lower monthly payments but can result in paying more interest over time.

Q: What is included in the terms and conditions of a loan?

A: The terms and conditions of a loan typically include details about the loan amount, interest rate, repayment schedule, fees, and any other requirements set by the lender. It is important to carefully review and understand these terms before agreeing to a loan.

Q: How can I lower my monthly loan payment?

A: You can lower your monthly loan payment by extending the loan term, refinancing at a lower interest rate, consolidating debt, or negotiating with your lender for a more manageable repayment plan. Keep in mind that extending the loan term may increase the total cost of the loan.

Q: What is the term of the loan?

A: The term of the loan refers to the duration over which you are expected to repay the borrowed amount. Loan terms can vary from a few months to several years, depending on the type of loan and agreement with the lender.

Q: How can I get a personal loan with favorable terms?

A: To obtain a personal loan with favorable terms, maintain a good credit score, provide documentation of your income and financial stability, shop around for the best loan offers, and negotiate with lenders for better terms and conditions.

Source Links

- https://www.quickenloans.com/learn/loan-terms

- https://www.investopedia.com/loan-terms-5075341

- https://www.experian.com/blogs/ask-experian/how-to-choose-the-best-loan-term-for-your-needs/